William Briggs explains why Obama's plan to tax the rich always fails eventually:

Here is the way the federal budget process has worked in practice—I do not say in theory, but in actuality. A projection is made of revenues (taxes). The government plans to spend all those monies and usually a little more. When the projections are accurate, the deficit grows only slowly, and in some years even decreases. These years are and have been infrequent; therefore it is rational to believe that these years will continue to be infrequent. It is irrational to believe that deficits will not continue to grow on average.

Much more often the projection is wrong. It is in error. It is overconfident. It is too sure. It says that more money will come in than actually does. This happens more frequently than do accurate projections.

The shortfall is recognized and then one or two things occurs, though both may also occur. The first is that the government “borrows” money, which increases the deficit and imperils future projections, making them less certain. The second is that taxes are raised. The argument is always, “Look, the hole is there. It can only be filled with money. If we don’t fill it now, danger looms.” This reasoning is often convincing because of the ever-nearness of elections.

Once the taxes are raised, new and higher projections are made based on the assumption that more money will flow to the government (and away from people). The budget is made on these projections; the government plans to spend all these new monies and usually a little more. When the projections are accurate…but never mind.

We are in an unbreakable loop. It ever ratchets up taxes and spending, which positively increases the power of the government.

1 comment:

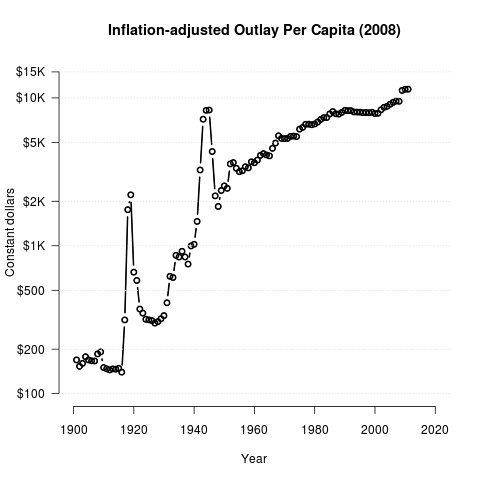

It's as if 1913 was somehow important.

Post a Comment